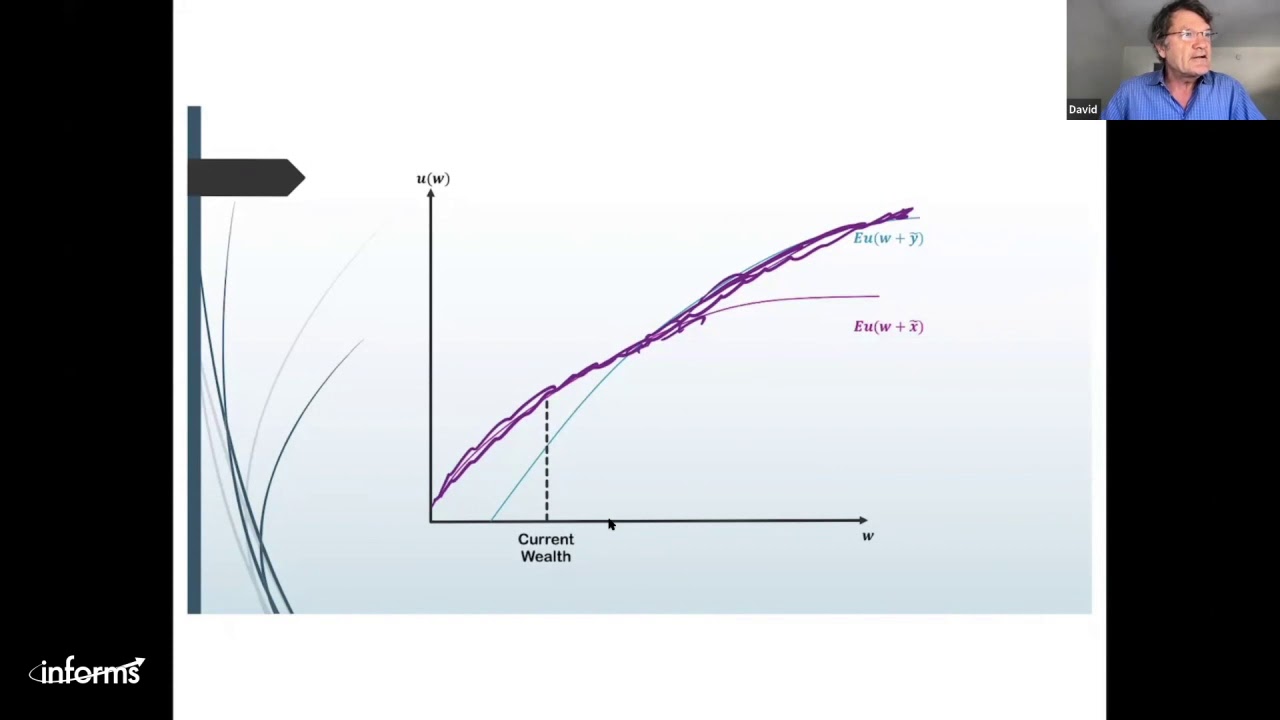

We provide behavioral foundations of a preference model for risky payoff streams, a broad domain having timed lotteries, income streams under certainty, and repeated lotteries as special cases. Following expected utility and the notion that time is perceived as inherently uncertain, we inadvertently rediscover Bell’s (1974) model. To this bedrock, we add the notion that preferences are affected by range effects. The result is a behavioral model with a broad domain and consistent with a plethora of phenomena (bias towards short payback periods, the four-fold patterns for risk and time, preference reversals for risk and time, temporal patterns of decreasing or increasing impatience, and magnitude effects).